Cross-Border Investment Opportunities With Bitcoin

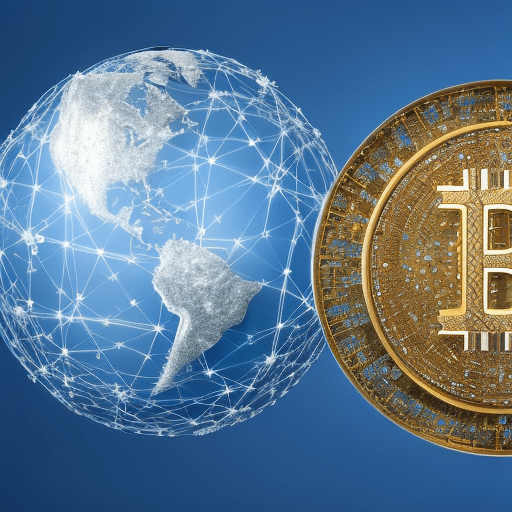

In a world where borders and restrictions often hinder investment opportunities, Bitcoin emerges as a game-changer. Its decentralized nature and borderless functionality open up new vistas for cross-border investments. With its potential to break down barriers and navigate international markets, Bitcoin becomes a catalyst for global investment growth. This article delves into the exciting realm of cross-border investment opportunities with Bitcoin, exploring the immense potential it holds for maximizing returns and embracing the future of borderless investing. Key Takeaways Bitcoin facilitates seamless and efficient cross-border transactions by eliminating intermediaries and reducing costs and delays. Bitcoin’s decentralized nature allows for international investments, mitigating risks and enhancing returns. Bitcoin promotes global financial inclusion by providing access to financial services and facilitating cross-border transactions. Bitcoin enables individuals and businesses to tap into new investment opportunities worldwide by bypassing limitations and fees associated with traditional cross-border transactions. The Global Reach of Bitcoin Bitcoin’s ability to seamlessly facilitate cross-border transactions has made it a promising investment opportunity for individuals and businesses looking to expand their global reach. With traditional banking systems often constrained by geographic boundaries and expensive transaction fees, Bitcoin offers a decentralized and borderless alternative. Its peer-to-peer nature allows for direct and secure transactions between parties, eliminating the need for intermediaries or third-party involvement. This not only reduces costs but also speeds up the transaction process. Additionally, Bitcoin’s digital nature allows for easy accessibility and transferability across borders, making it an ideal choice for those seeking to diversify their investment portfolio and tap into new markets. As a result, Bitcoin has gained popularity as a means to expand business operations and reach a wider global audience. Expanding Investment Horizons With Bitcoin The utilization of digital currency in diversifying investment portfolios presents a unique avenue for expanding horizons and exploring new investment options. As global investment trends continue to evolve, investors are increasingly seeking ways to expand their investment opportunities beyond traditional asset classes. Bitcoin, as a decentralized and borderless digital currency, offers a promising solution to break down barriers and tap into new markets. With its ability to facilitate cross-border transactions quickly and securely, bitcoin provides a new avenue for investors to access emerging markets and diversify their portfolios. Moreover, the growing acceptance and adoption of bitcoin in various countries further enhances its potential as a global investment tool. By embracing this digital currency, investors can not only expand their investment horizons but also benefit from the freedom and flexibility it offers. With this in mind, let’s now delve into how bitcoin can break down barriers and enable cross-border investments. Breaking Down Barriers: Bitcoin and Cross-Border Investments In the realm of global finance, the seamless transmission of funds across international boundaries remains a significant challenge for investors. However, with the advent of Bitcoin, there are expanding opportunities for overcoming these barriers. Bitcoin, a decentralized digital currency, has gained popularity as a means of cross-border investments due to its borderless nature and low transaction fees. By utilizing blockchain technology, Bitcoin enables investors to bypass traditional banking systems and conduct transactions directly with each other. This eliminates the need for intermediaries and reduces costs and delays associated with cross-border remittances. Furthermore, Bitcoin’s decentralized nature ensures that governments and financial institutions have limited control over these transactions, providing individuals with financial autonomy and freedom. As a result, Bitcoin presents a promising solution for investors seeking to navigate the challenges and expand their cross-border investment opportunities. Unleashing the Potential: Bitcoin’s Impact on International Investing Bitcoin has the potential to significantly impact international investing by promoting global financial inclusivity and enabling decentralized cross-border transactions. As a decentralized digital currency, Bitcoin bypasses traditional financial intermediaries and allows individuals and businesses to engage in cross-border transactions without the need for costly and time-consuming processes. This has the potential to unleash new opportunities for investment and economic growth on a global scale. Global Financial Inclusivity With the rise of digital currencies, there is a growing potential for fostering global financial inclusivity. Decentralized banking, facilitated by cryptocurrencies like Bitcoin, has the ability to provide financial services to the unbanked and underbanked populations around the world. Traditional banking systems often exclude these individuals due to various barriers, such as lack of documentation or physical access to banking facilities. Cryptocurrencies, on the other hand, offer a decentralized and borderless financial system that can be accessed by anyone with an internet connection. However, for global financial inclusivity to be fully realized, there needs to be a balanced approach to cryptocurrency regulation. Governments and regulatory bodies must work towards creating a regulatory framework that promotes innovation and consumer protection, while also mitigating risks such as money laundering and fraud. Striking this balance will be crucial in harnessing the potential of digital currencies for greater financial inclusion on a global scale. Decentralized Cross-Border Transactions Decentralized digital currencies have the potential to revolutionize international transactions, allowing for seamless and efficient transfer of value across borders. With the rise of decentralized finance (DeFi), individuals and businesses can now access a wide range of cross-border investment opportunities using cryptocurrencies like Bitcoin. Here are some key advantages of decentralized cross-border transactions: Lower transaction fees: Traditional remittance options often come with high fees, especially for cross-border transfers. DeFi platforms enable users to bypass intermediaries, resulting in reduced transaction costs. Faster settlement times: Cross-border transactions can take days or even weeks to settle through traditional banking systems. DeFi allows for near-instantaneous settlement, enabling faster access to funds. Greater financial inclusivity: Decentralized finance opens up investment opportunities to individuals who may not have access to traditional banking services, promoting financial inclusivity. Enhanced privacy and security: Decentralized transactions offer a higher level of privacy and security compared to traditional banking systems, protecting users’ financial information. These advantages make decentralized cross-border transactions an attractive option for individuals and businesses looking for efficient and cost-effective ways to engage in international investment and cross-border remittances. Embracing Cross-Border Opportunities With Bitcoin The growing global acceptance of digital currencies has paved the way for new cross-border investment opportunities. Embracing technological advancements, such as Bitcoin, has enabled individuals and businesses to engage in cross-border financial transactions with greater ease and efficiency. Bitcoin, as a decentralized digital currency, offers a borderless and secure platform for conducting financial transactions across different countries and currencies. One of the key advantages of using Bitcoin for cross-border investments is the elimination of intermediaries, such as banks or payment processors, which often introduce delays and additional costs. With Bitcoin, individuals can directly transfer funds to recipients in different countries, bypassing traditional banking systems. This not only reduces transaction costs but also ensures faster settlement times. Furthermore, Bitcoin provides a level of anonymity and privacy that is highly valued by those seeking financial freedom. Transactions made with Bitcoin do not require personal information, and the blockchain technology behind it ensures transparency while protecting user identities. Overall, embracing cross-border opportunities with Bitcoin allows investors to tap into global markets seamlessly, enabling greater financial freedom and expanding investment horizons. Capitalizing on Global Markets With Bitcoin As the world becomes more interconnected and global markets continue to expand, capitalizing on these opportunities is essential for businesses seeking growth and success. Bitcoin, with its borderless and decentralized nature, offers a unique advantage for individuals and businesses looking to access global markets. By leveraging the power of blockchain technology, bitcoin enables cross-border transactions that are faster, more secure, and cost-effective, making it an attractive option for those looking to capitalize on global market opportunities. Global Market Accessibility Investors can now access global markets with ease, thanks to the increasing accessibility of bitcoin as a cross-border investment option. This digital currency has the potential to streamline cross-border payments and enhance global financial integration. Here are some key advantages of utilizing bitcoin for global market accessibility: Faster transactions: Bitcoin enables near-instantaneous cross-border transactions, eliminating the need for intermediaries and reducing transaction times. Lower costs: Traditional cross-border transactions often involve high fees, currency exchange rates, and delays. Bitcoin offers lower transaction costs, making it an attractive option for investors seeking cost-effective global market access. Greater transparency: Bitcoin operates on a decentralized blockchain technology, providing transparent and immutable records of transactions. This transparency can enhance investor trust and help prevent fraudulent activities. Increased liquidity: Bitcoin’s global nature and 24/7 availability make it highly liquid, allowing investors to buy and sell assets quickly, regardless of time zones or geographical boundaries. Bitcoin’s Borderless Advantage Bitcoin’s borderless nature allows for seamless global transactions, facilitating efficient cross-border financial integration. This has had a significant impact on remittances, enabling individuals to send and receive money across borders quickly and at a lower cost compared to traditional methods. Bitcoin’s decentralized nature eliminates the need for intermediaries, reducing transaction fees and delays. Additionally, the use of bitcoin in cross-border e-commerce has gained traction in recent years. Merchants can accept bitcoin as a payment method, eliminating the need for currency conversions and reducing the risk of fraud. Bitcoin’s blockchain technology provides transparency and security, which is crucial in cross-border transactions. As a result, businesses and individuals can engage in global trade more easily, fostering economic growth and expanding opportunities for cross-border investment. Capitalizing on Cross-Border Transactions The increasing prevalence of global transactions has created a need for efficient and secure financial solutions. Capitalizing on digital assets and leveraging cryptocurrency can provide individuals and businesses with opportunities to optimize cross-border transactions. Here are four key ways to capitalize on digital assets and leverage cryptocurrency for cross-border transactions: Instant and low-cost transactions: Cryptocurrency enables instant transactions at a fraction of the cost compared to traditional banking systems. Borderless accessibility: Digital assets like Bitcoin can be accessed and used across borders without the need for intermediaries or traditional banking systems. Security and privacy: Cryptocurrency transactions are secure and offer a level of privacy not always available with traditional financial systems. Investment opportunities: By capitalizing on digital assets, individuals can invest in cryptocurrencies and potentially benefit from their growth and market opportunities. Bitcoin’s Role in Diversifying Investment Portfolios Across Borders Bitcoin’s ability to diversify investment portfolios across borders is an attractive feature for global investors seeking new opportunities. The decentralized nature of Bitcoin allows investors to leverage its potential for international investments, providing an alternative to traditional financial systems. By incorporating Bitcoin into their portfolios, investors can access new markets and assets that were previously unavailable or limited due to geographical restrictions or regulatory barriers. This diversification can help mitigate risks and enhance potential returns. Additionally, Bitcoin’s borderless nature eliminates the need for intermediaries and reduces transaction costs, making cross-border investments more efficient and cost-effective. Moreover, the transparency and security provided by blockchain technology offer investors greater confidence in the integrity of their investments. As a result, Bitcoin’s impact on portfolio diversification and its potential for leveraging international investments make it a powerful tool for investors seeking to expand their horizons and capitalize on new opportunities. Seizing the Advantage: Bitcoin’s Edge in Cross-Border Investments In the realm of global finance, Bitcoin’s ability to seamlessly facilitate transactions across international borders gives investors a distinct advantage. With its decentralized nature and borderless accessibility, Bitcoin offers several unique benefits for cross-border investments: Faster transactions: Bitcoin transactions are processed quickly, eliminating the need for lengthy processing times and reducing transaction costs. Lower fees: Traditional banking systems often charge high fees for cross-border transactions, while Bitcoin transactions typically incur minimal fees, making it more cost-effective for investors. Increased security: Bitcoin transactions are secured through cryptography, providing a level of anonymity and protection against fraud. Greater control: With Bitcoin, investors have full control over their funds, eliminating the need for intermediaries and giving them the freedom to manage their investments independently. Unlocking New Markets With Bitcoin Bitcoin has the potential to unlock new markets by promoting global financial inclusion and streamlining cross-border transactions. With its decentralized nature and borderless transactions, Bitcoin allows individuals from underserved regions to participate in the global economy and gain access to financial services. Furthermore, by eliminating intermediaries and reducing transaction costs, Bitcoin can facilitate faster and more efficient cross-border transactions, thus opening up new opportunities for businesses to explore untapped markets worldwide. Global Financial Inclusion The promotion of global financial inclusion is crucial for achieving economic growth and reducing poverty levels around the world. In order to foster global financial inclusion, it is important to expand investment opportunities for individuals and businesses across different countries. This can be achieved through various means, such as: Providing access to affordable financial services, including banking and credit facilities, to individuals and small businesses in underserved areas. Promoting financial literacy and education to empower individuals to make informed financial decisions and participate in the global economy. Encouraging the use of digital payment systems and mobile banking to facilitate easy and secure transactions across borders. Establishing inclusive regulatory frameworks that promote transparency, consumer protection, and fair competition in the financial sector. Streamlining Cross-Border Transactions Streamlining cross-border transactions is crucial for enhancing cross-border remittances and reducing transaction costs. In today’s globalized world, individuals and businesses are increasingly engaging in international transactions, making it essential to have efficient and cost-effective cross-border payment systems. Traditionally, cross-border transactions have been plagued by high fees, lengthy processing times, and complex regulatory requirements. However, with the advent of digital technologies and innovative financial solutions, there has been a significant push to streamline these processes. One such solution is the use of blockchain technology, which offers secure and transparent peer-to-peer transactions. Blockchain-based platforms, such as Bitcoin, provide a decentralized network that enables faster and cheaper cross-border transfers. By eliminating intermediaries and reducing transaction fees, cryptocurrencies like Bitcoin have the potential to revolutionize cross-border remittances, making them more accessible and affordable for individuals around the world. Overall, streamlining cross-border transactions is essential for enhancing financial inclusion and fostering economic freedom by reducing transaction costs and improving the accessibility of cross-border remittances. Navigating International Investments With Bitcoin As the global economy becomes increasingly interconnected, understanding the intricacies of international investment strategies is crucial for navigating the ever-evolving landscape. When it comes to expanding cross-border opportunities and navigating regulatory challenges, Bitcoin has emerged as a powerful tool for investors. Here are some key points to consider: Borderless transactions: Bitcoin allows for seamless cross-border transactions, eliminating the need for intermediaries and reducing transaction costs. Increased liquidity: Bitcoin’s global nature provides investors with access to a broader pool of potential buyers and sellers, enhancing liquidity. Diversification: Investing in Bitcoin offers diversification benefits, as it is not tied to any specific country or economy. Regulatory considerations: However, navigating international investments with Bitcoin requires careful attention to regulatory challenges and compliance with different jurisdictions’ laws. Understanding these aspects can empower investors to take advantage of the expanding cross-border opportunities while effectively managing regulatory challenges. Maximizing Returns: Bitcoin’s Potential in Cross-Border Investing Investors can harness the potential of Bitcoin to optimize their returns in the realm of international finance and explore new avenues for growth. Bitcoin, as a decentralized digital currency, offers unique advantages in cross-border investment strategies. With its borderless nature and fast transactions, Bitcoin enables investors to maximize returns by eliminating intermediaries and reducing transaction costs. Additionally, Bitcoin’s blockchain technology provides transparency and security, making cross-border transactions more efficient and secure. By using Bitcoin for cross-border investments, investors can access markets that may be otherwise difficult to enter due to regulatory restrictions or limited infrastructure. Furthermore, Bitcoin’s potential for appreciation can result in significant gains for investors. However, it is important to note that Bitcoin’s volatility and regulatory uncertainties should be carefully considered when implementing cross-border investment strategies. Overall, Bitcoin presents a compelling opportunity for investors looking to maximize returns and explore new avenues for growth in the international finance landscape. Embracing the Future: Bitcoin’s Influence on Global Investment Landscape The increasing adoption and integration of digital currencies into global financial systems is transforming the investment landscape and shaping the future of international finance. Bitcoin, the pioneering cryptocurrency, has emerged as a disruptive force with significant potential to impact developing economies and revolutionize cross-border remittances. Here are four key ways in which bitcoin is influencing the global investment landscape: Empowering individuals in developing economies: Bitcoin provides access to financial services for the unbanked population, enabling them to participate in the global economy and escape poverty. Reducing remittance costs: Bitcoin offers a cheaper and faster alternative to traditional remittance methods, allowing individuals to send money across borders with lower fees and quicker settlement times. Increasing financial inclusion: Bitcoin’s decentralized nature removes the need for intermediaries, making it easier for individuals without access to traditional banking services to participate in the global financial system. Fostering economic growth: By facilitating cross-border transactions, bitcoin has the potential to stimulate economic growth in developing economies, attracting investment and creating new opportunities. As digital currencies continue to gain traction, the future of cross-border remittances and the impact of bitcoin on developing economies hold promising prospects for a more inclusive and accessible global financial system. The Power of Borderless Investing: Bitcoin’s Contribution to International Markets Bitcoin’s ability to facilitate seamless and efficient transactions across international markets has the potential to revolutionize the way individuals and businesses conduct financial transactions. This global payment revolution is fueled by the decentralized nature of Bitcoin, which allows for cross-border financial integration without the need for intermediaries or traditional banking systems. With Bitcoin, individuals and businesses can bypass the limitations and fees associated with traditional cross-border transactions, enabling them to engage in borderless investing and tap into new investment opportunities worldwide. The table below highlights the key advantages of Bitcoin in cross-border investing: Advantages of Bitcoin in Cross-Border Investing Secure and transparent transactions Lower transaction costs Fast and efficient settlement Access to global investment opportunities Frequently Asked Questions What Are the Benefits of Using Bitcoin for Cross-Border Investments? Bitcoin offers numerous benefits for cross-border investments. Its decentralized nature allows for fast and secure transactions, eliminating the need for intermediaries. Additionally, its global accessibility and lower transaction fees make it an attractive option for investors seeking borderless opportunities. How Does Bitcoin Overcome the Challenges Faced in Traditional Cross-Border Investments? Bitcoin overcomes challenges in traditional cross-border investments through its impact on investment strategies and reduction of transaction costs. Its decentralized nature and global accessibility enable faster, cheaper, and more secure transactions, revolutionizing the way cross-border investments are conducted. What Are the Potential Risks Associated With Investing in Bitcoin for International Markets? Potential risks associated with investing in Bitcoin for international markets include regulatory challenges, market volatility, security breaches, and lack of consumer protections. Investors should carefully assess these risks before engaging in cross-border Bitcoin investments. Can Bitcoin Be Used as a Tool for Diversifying Investment Portfolios Across Borders? Bitcoin can serve as a hedge against currency fluctuations and has the potential to impact capital controls in cross-border investments. It offers a decentralized and borderless alternative for diversifying investment portfolios across borders. How Does Bitcoin’s Influence on the Global Investment Landscape Contribute to the Future of International Markets? Bitcoin’s impact on global investment trends and the role of blockchain technology in cross-border investments contribute to the future of international markets by providing a decentralized and secure platform for conducting borderless transactions, fostering economic growth and financial