Altcoin Investment Guidelines

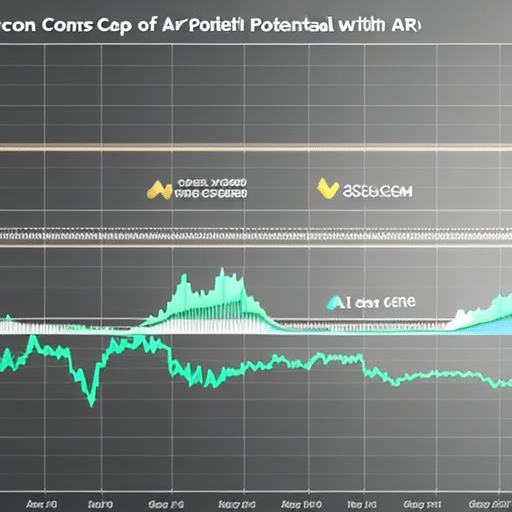

Investing in cryptocurrencies, or altcoins, has become increasingly popular as more individuals and institutions are entering the space. Altcoins can provide investors with a range of different opportunities for growth and potential rewards. However, it is important to understand the associated risks and regulations before investing in these digital assets. This article seeks to provide guidance on how to make informed decisions when investing in altcoins. It outlines key guidelines that should be taken into consideration such as researching the market, understanding risks, setting realistic expectations and protecting investments. Utilising research tools and staying informed can also help reduce risk while maximising returns. By following these guidelines, investors can make well-informed decisions when allocating funds for altcoin investments. Key Takeaways Thorough research of the altcoin market is essential Understanding current growth trends and potential regulatory changes is important Diversifying portfolios can help maximize returns and spread out risk Staying informed with the latest news and developments in the industry is crucial Research the Altcoin Market Conducting thorough research about the altcoin market is essential for successful investment decisions. It is important to gain an understanding of the current growth trends and any potential regulatory changes in order to make informed decisions about investing in an altcoin. Doing so requires analyzing charts, reading news reports, and researching economic data related to a particular coin or sector of coins. By taking the time to deeply study these factors, investors can determine which coins may have long-term sustainability and be a good investment option. Additionally, it is important to keep up with industry updates as new developments may impact future value projections. Knowing what the current market looks like allows investors to decide on their own investment strategy when it comes to buying into altcoins. Having this knowledge will enable them to make more informed decisions when making investments that could potentially bring larger returns down the line. Decide on Your Investment Strategy Determining a sound strategy is essential to successful cryptocurrency trading. Before investing, it is important to analyze past trends and performance of the altcoin market. By studying past data, investors can gain insight into which coins are likely to yield the most profit, as well as any potential risks associated with the investment. A great way to get an overall view of altcoin market performance is by using a two-column and three-row table in markdown format. The first column should contain all the major altcoins that have been tracked over time, while the second column should include any relevant information about each coin such as its current price or recent growth rate. Using this method allows investors to quickly compare different coins and determine which ones offer the best potential for returns. From there, they can better understand what strategies may work best for their individual goals and risk tolerance levels. Having this knowledge will help investors make informed decisions regarding their investments so they can maximize profits while minimizing losses. With careful analysis of both past trends and current performance, investors can create an effective investment plan that suits their specific needs and objectives. As such, understanding the risks involved in entering the crypto market is key before moving forward with any investments. Understand the Risks of Investing Analyzing the potential risks associated with cryptocurrency investments is critical for any investor looking to enter the market. Investment psychology and risk management are key considerations when deciding to invest in alternative coins. Investing in cryptocurrencies carries a high risk of financial loss due to: Volatility of prices Lack of regulation Limited liquidity Security concerns related to storage and transfer of digital assets Risk of fraud and other criminal activity It’s important to understand the risks involved with investing in cryptocurrencies so that investors can set reasonable expectations for their financial goals. It is also important to have an exit strategy if needed, as well as contingency plans in case of unexpected events or unforeseen market activity. Set Reasonable Expectations Establishing reasonable expectations for financial goals is essential to successful investing in cryptocurrencies. When entering the market, investors should be aware of the inherent volatility and risk associated with any cryptocurrency investment. It is important to understand that prices can fluctuate wildly and investments can move from gains to losses quickly. Additionally, it is wise to take into account the security measures necessary for safeguarding against hacking attempts or other malicious activities. A good investor will have a well-crafted strategy that takes into account these risks and has reasonable expectations for returns on investment. With foresight and planning, an investor can minimize risk while still taking advantage of potential profits available in the cryptocurrency markets. Taking these precautions allows for a more secure experience when investing in cryptocurrencies, helping to ensure expectations are met without disappointment or excess risk-taking. As such, understanding potential risks is vital before moving forward with any investment decisions in altcoins, as this helps set realistic goals and expectations that will enable successful outcomes. From there, investors can then consider the tax implications of their investments before making any decisions regarding altcoin investments. Know the Tax Implications Understanding the potential tax implications of cryptocurrency investments is an important step in making informed decisions that can help maximize returns. Tax laws related to cryptocurrencies vary from country to country and investors should explore these laws thoroughly before investing. It is also recommended that investors familiarize themselves with their rights so they can protect themselves in case of any disputes or unforeseen issues. Here are some key points to consider: Be aware of capital gains taxes; Different countries have different regulations for taxation on cryptocurrencies; Understand the rules regarding reporting losses and profits from crypto transactions. Taking the time to understand these nuances will better equip investors to make informed decisions about their investments and ensure compliance with local regulations. Additionally, it will help investors maintain a responsible approach towards investing which is essential for successful altcoin investment strategies over the long-term. Invest Responsibly Cultivating a responsible attitude towards investments in cryptocurrency is essential for long-term success. It is important to understand the regulations and laws that govern cryptocurrency trading, as well as consider any fees associated with trading activities. To ensure a successful investment experience, investors must take the time to thoroughly research before investing. The following table provides an overview of the most important considerations when it comes to altcoin investment: Consideration Consequence Understand Regulations Unclear rules can lead to unexpected risks and losses. Consider Fees High transaction fees can make or break an investment decision. Investors should also be aware of the volatility of cryptocurrencies, which could result in significant gains or losses depending on market conditions. By investing responsibly, investors can protect their assets from potential risks while taking advantage of potential growth opportunities in the cryptocurrency markets. Ultimately, understanding regulations and considering fees are key components for ensuring a successful altcoin investment strategy. Find a Trusted Exchange Finding a reliable exchange is essential for investors seeking to capitalize on trading opportunities in the cryptocurrency markets. When evaluating options, it is important to consider factors such as analyzing fees, liquidity, security protocols and user-friendliness of the platform. Investors should also take into account their own level of investment knowledge when selecting an appropriate exchange. By looking at these criteria carefully, investors can evaluate which exchanges are most suitable for their individual needs. Additionally, they may find that certain exchanges offer additional features or better customer support than others. Having found a trusted exchange with which to begin trading altcoins, investors can then look to diversify their portfolios by investing in a variety of coins. Invest in Diverse Portfolios In order to capitalize on potential trading opportunities in the cryptocurrency markets, constructing a diverse portfolio of coins can help investors maximize their returns. By diversifying their portfolio, investors can spread out risk and evaluate performance across different currencies. This table provides an example of how a portfolio could be allocated for maximum benefit: Coin Percentage Reasoning BTC 40% Established ETH 30% Smart Contracts & Dapps XRP 15% Fast transactions & Low Fees LTC 10% Price stability & Segwit support BCH 5% High transaction throughput & Lower fees than BTC Investors should always do their own research and stay informed about market conditions before investing in any particular coin or token. By doing so, they may be able to take advantage of changes in the market that increase or decrease demand for various altcoins. With this knowledge, investors can adjust their portfolios accordingly and maximize the return on investment from each coin they hold. To further enhance returns, it is important to utilize research and analytical tools when making decisions about which coins to invest in and when to sell them off. Utilize Research and Analytical Tools Assessing the cryptocurrency market through research and analytical tools can provide insight into potential trading opportunities. By analyzing trends, monitoring prices, and keeping up to date with the latest news stories related to altcoins, investors can gain a better understanding of how their investments may perform. These analysis techniques can help investors decide when to enter or exit a trade in order to maximize profits and minimize losses. Additionally, these tools allow for more accurate predictions regarding future price movements due to their ability to detect patterns from past data. By utilizing these research and analytical tools, investors will have access to valuable information that could be vital for making informed decisions about their investments. With this information at hand, investors are more likely to protect their investments while achieving greater returns in the long-term. Protect Your Investment Considering the volatile nature of the cryptocurrency market, protecting investments requires a strategic approach. This includes smart investment timing, selecting secure wallets to store digital assets, and limiting exposure to losses. When investing in altcoins, it is important to be aware of underlying risks and keep up with industry news as well as any potential changes that could impact an altcoin’s value. Having a thorough understanding of the asset can help investors make informed decisions about their investment strategies and protect their investments from loss. Additionally, it is essential for investors to regularly monitor their portfolios to ensure they are staying informed on the latest developments in order to make timely decisions regarding when to buy or sell an asset. By following these guidelines, investors can work towards mitigating risk and safeguarding their investments against significant losses due to market volatility. To stay ahead of trends and maintain current knowledge of the cryptocurrency landscape, it is important for investors to remain informed on the latest news and developments in the space. Stay Informed Staying abreast of industry news is akin to navigating treacherous waters; the slightest misstep can have costly consequences. In order to make wise decisions in altcoin investing, it is essential to stay informed with the latest news and developments in the industry. One way to do this is by regularly monitoring relevant news sources, such as cryptocurrency-related blogs, social media accounts, forums, and other online communities. This will help investors stay up-to-date on the performance of their investments as well as any changes or updates that could affect them. Additionally, joining online communities dedicated to discussing altcoins can be a great way to gain insight into different projects and get advice from experienced investors. Being part of these conversations can also provide valuable information on upcoming events and developments in order to better inform investment decisions. Frequently Asked Questions What cryptocurrencies are available for investment? Cryptocurrencies available for investment include those based on blockchain technology and crypto mining. Bitcoin, Ethereum, Litecoin, XRP and various altcoins are some of the most popular options. Each has unique features to consider before investing. Is it safe to store my altcoins on an exchange? When investing in altcoins, it is important to consider the security protocols of an exchange when storing them. Diversifying risk by using a wallet that is not connected to an exchange can reduce the potential for loss. What fees should I expect when investing in altcoins? When investing in altcoins, one should expect to incur fees such as deposit fees and trading fees. These fees can vary depending on the type of altcoin and exchange used, and should be taken into account when making an investment decision. How do I know if an altcoin is a good investment? Analyzing trends and evaluating risks are important when determining if an altcoin is a good investment. Doing research on the coin’s history, team, circulating supply, market capitalization and liquidity can help investors make informed decisions. What resources exist to help me research altcoins? Researching altcoins can be complex, but there are many resources available to help. Crypto forums, trading bots and websites dedicated to tracking trends offer valuable insight for investors. By analyzing data, one can gain a deeper understanding of an altcoin’s potential as an