Renewable Energy Certificates For Crypto Mining

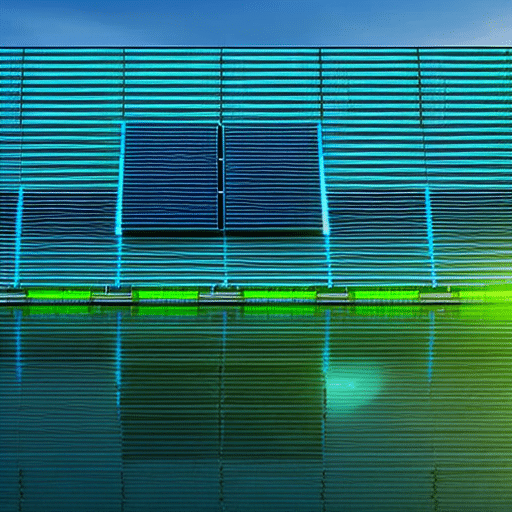

Renewable energy certificates (RECs) are a form of environmental credentialing system designed to promote the development and use of renewable energy sources in order to reduce emissions. In recent years, RECs have been increasingly used for crypto mining operations due to their potential for reducing costs and improving sustainability. This article will analyze the advantages and disadvantages of using RECs for crypto mining, as well as their economic implications and future outlook. In addition, it will investigate whether or not RECs can become standard practice in the crypto mining industry, and what impact they may have on its economics. Overview of Renewable Energy Certificates Renewable Energy Certificates (RECs) are a form of tradable energy commodity used to encourage the production of electricity generated from renewable energy sources such as wind, solar, and hydroelectric power. RECs represent the environmental attributes associated with one megawatt-hour (MWh) of renewable electricity generation and can be issued by an accredited registry after their certificate verification process. By tracking RECs, it is possible to demonstrate that a certain amount of electricity was generated from a renewable source such as solar or wind instead of fossil fuels. With regards to energy efficiency, owning RECs helps consumers offset their carbon footprint since they do not directly consume the physical electricity but instead purchase certificates representing green kWh produced elsewhere. Additionally, the ownership of RECs allows for customers to become more engaged with their utility providers and have greater access to cleaner energy sources. As such, this transition into the subsequent section about advantages of using recs for crypto mining serves as a reminder that utilizing renewable energy certificates can provide numerous benefits in both traditional power markets and cryptocurrency mining operations alike. Advantages of Using RECs for Crypto Mining Utilizing RECs for crypto mining can provide numerous advantages. It has the potential to reduce the environmental impact of digital currencies and their associated carbon footprint. By utilizing renewable energy certificates, crypto miners are able to purchase certificates from renewable energy sources that guarantee a certain amount of their electricity consumption is coming from renewable resources. This means that they are not solely relying on traditional fossil fuels, which release more pollutants into the environment than non-renewable sources. Additionally, using RECs can help make cryptocurrency mining more sustainable in the long run as it reduces reliance on non-renewable sources of energy and encourages miners to use more renewable alternatives instead. Ultimately, this helps reduce the environmental damage caused by traditional mining practices and makes cryptocurrency mining more eco-friendly. In addition to reducing environmental impacts, using RECs for crypto mining also helps miners save money over time as renewable energy is typically cheaper than non-renewable sources when purchased in bulk amounts or through long-term contracts with providers. In some cases, this cost savings could be substantial enough to offset any initial investments made in purchasing certificates or equipment such as solar panels needed for offsite installations. As a result, adopting renewable energy certificate usage for crypto mining operations can be both beneficial economically and environmentally by reducing costs while also helping preserve our planet’s resources for future generations. With these advantages in mind, it is clear why many miners are now turning towards using RECs as part of their operations. Transitioning into discussing the disadvantages of using RECs for crypto mining will further demonstrate how beneficial this practice can be overall when used correctly and responsibly Disadvantages of Using RECs for Crypto Mining Despite the numerous advantages of using renewable energy certificates for cryptocurrency mining, there are also some drawbacks that should be taken into consideration. Approximately 85% of the world’s crypto miners still rely solely on traditional fossil fuels, indicating a potential lack of adoption when it comes to RECs. Additionally, while RECs can certainly reduce the environmental costs and carbon footprint associated with crypto mining operations, many of these certificates do not necessarily guarantee 100% renewable energy usage. This is due to the fact that RECs can often include power sources such as nuclear or hydroelectric plants, which may not meet all renewable energy requirements. As such, relying on RECs for crypto mining may still come with certain environmental risks. Nevertheless, with more research and careful selection of RECs by miners, these drawbacks can be minimized. In order to fully understand the economic implications associated with using RECs for crypto mining however requires further examination. Economic Implications of Using RECs for Crypto Mining The economic implications of utilizing renewable energy certificates for cryptocurrency mining must be considered when evaluating its potential benefits. When renewable energy certificates are used to power crypto mining, the cost is reduced due to lower electricity bills. This can help miners become more competitive on the crypto market, as well as make it easier for them to generate profits while still being mindful of their environmental impact. Yet another economic implication of using RECs is that it could potentially lead to an increase in demand for specific types of renewable energy sources. This could have a positive impact on markets and economies that rely heavily on these forms of green energy production, thus leading to more investment in this sector and creating new job opportunities in those areas. Ultimately, the utilization of RECs for crypto mining has the potential to reduce costs and decrease environmental impact – both positive outcomes with long-term economic implications that should be taken into consideration when assessing its value. Moreover, this could also lay the groundwork for RECs becoming a standard part of the cryptocurrency industry in the future. Potential for RECs to Become Standard in Crypto Mining Industry Given the advantages of RECs for crypto mining, there is potential for them to become a standard in this industry; one must ask whether RECs can sustain their momentum and continue to be an integral part of cryptocurrency mining. To answer this question, it is important to consider the various investment opportunities that are available through RECs, as well as the different energy sources that could be used in conjunction with RECs. The following bullets can provide insight into these two aspects: Investment opportunities: Increased access to capital markets, diversification of investments, and reduced risk for renewable energy projects. Energy sources: Solar, wind, hydropower, geothermal power plants and other alternative sources of electricity. As cryptocurrency mining continues to evolve and grow in popularity, it will be critical for stakeholders to assess the potential for RECs to become standard in this industry. In order to do so effectively, understanding both the investment opportunities that come with using RECs and how different energy sources may fit into such a model is essential. With these considerations in mind, it is now necessary to evaluate the regulatory framework surrounding using RECs for crypto mining. Regulatory Framework for RECs in Crypto Mining Regulatory frameworks are essential for assessing the potential of RECs to become a standard in the cryptocurrency industry. A thorough regulatory framework should address both the certificate efficacy as well as sustainability costs associated with RECs. By establishing norms and standards, regulators can ensure that RECs are transparently tracked from source to end-user. Additionally, regulations must also account for different types of renewable energy sources and their varying costs across countries or regions. Furthermore, regulators need to assess how RECs interact with other environmental policies such as carbon pricing mechanisms or renewable portfolio standards when being used in crypto mining operations. These considerations will help determine the effectiveness and efficiency of using RECs to reduce emissions from crypto mining activities. Such an inquiry would provide valuable insights into the benefits of using RECs for crypto mining operations moving forward. Benefits of Using RECs for Crypto Mining The Regulatory Framework for RECs in Crypto Mining is an important topic to consider, as it can provide some insight into the potential benefits of using RECs for crypto mining. It is well known that using RECs can reduce carbon emissions and help support renewable energy initiatives. In addition, there are also financial incentives associated with their use. Here are three key benefits of utilizing RECs for crypto mining: Reduction in Carbon Emissions: By using Renewable Energy Certificates (RECs) to power cryptocurrency operations, miners can offset the amount of carbon dioxide generated from traditional electricity sources such as coal and natural gas. This helps to reduce overall emissions and promote sustainability. Financial Incentives: The use of RECs can result in cost savings as they are cheaper than other forms of energy production; thus, miners may benefit financially from their utilization. Support Renewable Energy Initiatives: Utilizing renewable energy certificates supports the growth and development of clean energy sources which helps to reduce our dependence on fossil fuels and create a more sustainable future. These are just some of the main advantages that come with using RECs for crypto mining operations; however, this does not guarantee success without addressing some challenges facing the adoption of these certificates in this field first. Challenges Facing the Adoption of RECs in Crypto Mining Adoption of RECs in the field of cryptocurrency mining has been met with certain challenges that must be addressed before its full potential can be realized. Firstly, scalability issues are at play as the number of cryptocurrencies increase and miners compete for finite sources of renewable energy. This has led to a glut in the supply of RECs, resulting in lower prices for their sales which could potentially make them less attractive to miners. Additionally, concerns have been raised about the environmental impact of using RECs for crypto mining since they do not necessarily guarantee emission reductions from other non-renewable sources. Thus, it is essential to consider how best to incentivize miners to utilize renewable resources without compromising on environmental standards. Industry Initiatives to Promote the Adoption of RECs In recent years, various industry initiatives have been launched to promote the increased utilization of renewable energy certificates (RECs) in cryptocurrency mining. These initiatives often focus on incentivizing organizations to adopt RECs through: Lowering certification costs for RECs Reducing carbon emissions associated with crypto mining activities Increasing public awareness of the benefits of utilizing RECs Establishing standards for tracking and verifying REC usage Such approaches are aimed at making it more affordable and easier for miners to take advantage of clean energy sources while also helping to reduce their environmental impact. By providing incentives such as these, the industry is taking steps towards a more sustainable future for crypto mining. Transitioning from traditional fossil fuel-based production to renewable energy sources has the potential to lead to a significant reduction in carbon emissions, thus making it an attractive option for miners looking to reduce their ecological footprint. Examples of Companies Using RECs in Crypto Mining Recent estimates suggest that nearly 50% of all cryptocurrency miners have adopted renewable energy certificates (RECs) to power their operations. This trend appears to be driven in part by a growing awareness of the need for risk management and proactive climate change mitigation strategies within the mining industry. Examples include Bitmain, which operates a number of mining facilities powered by RECs and is actively exploring ways to expand its use of renewable sources of energy. Another prominent example is Blockstream’s Bitcoin Mining Plan, which utilizes RECs from wind-generated electricity as one component of its larger sustainability initiatives. These companies recognize the importance of incorporating renewable forms of energy into their operations, in order to reduce their environmental impact while also providing financial benefits associated with lower energy costs. With this shift towards more sustainable practices, it is clear that companies involved in crypto mining are increasingly turning to RECs as an important tool for managing risk and responding to climate change concerns. As such, it will be interesting to see what further impacts these efforts may have on the economics of crypto mining moving forward. Impact of RECs on Crypto Mining Economics The use of renewable energy certificates (RECs) in crypto mining can have a significant impact on the economics of this activity. By reducing the costs of electricity, miners can greatly increase their profits while simultaneously decreasing their environmental impact. This is because RECs are used to certify that electricity was generated from renewable sources, such as solar or wind power, and thus they reduce the amount of non-renewable energy used in crypto mining operations. Additionally, RECs can also help improve energy efficiency by allowing miners to select the most efficient hardware for their operations. Numeric list: Reduction in electricity costs Decrease in environmental impact Improvement in energy efficiency Selection of most efficient hardware Overall, RECs offer numerous benefits for those involved in crypto mining activities and could be an effective way to reduce operating costs while still achieving a smaller environmental footprint. With these advantages taken into account, it’s clear that RECs will continue to play an important role when it comes to the economics and sustainability of crypto mining operations moving forward — paving the way for a more sustainable future for all involved parties. Future of RECs in Crypto Mining Going forward, RECs are expected to remain an integral part of the economic and environmental sustainability of operations related to cryptocurrency mining. The potential benefits for miners from using RECs include a reduction in operational costs associated with energy consumption as well as mitigating some of the environmental impacts associated with crypto mining activities. Cost-effectiveness is key when it comes to determining how much value can be gained by using a renewable energy certificate system for crypto mining. As such, miners must assess the long-term costs and benefits of participating in REC markets, taking into account factors such as availability, price stability and future pricing trends. Additionally, miners must consider how potential regulatory changes may affect their ability to access or participate in these markets. This analysis will therefore determine whether or not investing in RECs is a viable option for their business model going forward. With this knowledge, miners can decide if pursuing RECs is worth the effort and cost associated with them compared to other options available within crypto mining operations. As such, whileRECs are likely to become more popular over time due to their potential environmental and economic advantages, they remain largely an untapped resource when it comes to crypto mining operations today. Consequently, there is great potential for them becoming mainstream as awareness increases regarding their benefits both economically and environmentally. Potential for RECs to Become Mainstream With the potential for reducing operational costs and mitigating environmental impacts, RECs are gaining traction as a future-oriented solution to crypto-related operations. By utilizing renewable sources of energy such as solar, wind, and hydroelectric power, crypto miners can benefit from the carbon offsets offered by RECs. This mechanism could revolutionize the way that miners receive and use energy while becoming more conscious of their environmental footprint. Moreover, it could potentially lead to RECs becoming a mainstream component of crypto mining operations in the near future. As such, it is essential to consider both the advantages and disadvantages associated with using RECs for this purpose before making any decisions. Summary of Advantages and Disadvantages of Using RECs for Crypto Mining This article has explored the potential for Renewable Energy Certificates (RECs) to become mainstream in the crypto mining industry. The advantages and disadvantages of using RECs must now be considered in order to assess whether or not they should be adopted on a larger scale. This section will present a summary of these points in the form of a table, and analyze the implications of each factor. The following table outlines the key advantages and disadvantages associated with using RECs for crypto mining: Advantages Disadvantages Climate impact Cost Reduced emissions Availability Energy efficiency Difficulty tracking It is clear that there are both positive and negative aspects associated with utilizing RECs for crypto mining. On one hand, using RECs has been shown to reduce carbon emissions which can have positive effects on climate change. Additionally, energy efficiency can be improved by utilizing resources such as solar or wind power rather than traditional sources like coal or gas-fired plants. However, there are challenges that must be addressed when incorporating renewable resources into an existing infrastructure; cost implications can make this challenging due to potentially high upfront costs, while availability may also prove difficult depending on geographical location and local regulations regarding renewable energy production. Furthermore, it may also be difficult to track RECs throughout their lifecycle to ensure proper utilization of certificates at every stage. Frequently Asked Questions What are the different types of renewable energy certificates available? There are three main types of renewable energy certificates: certificate tracking systems, voluntary carbon credits, and mandatory carbon credits. Each type has its own distinct characteristics and can have varying impacts on the environment. It is important to understand each type before making a decision on which one to use. What is the cost of using renewable energy certificates for crypto mining? The cost of certificate trading and energy efficiency for crypto mining remains inconclusive, with estimates ranging from negligible to substantial. Analyzing current trends and existing research can provide detailed insight into the costs involved in this increasingly popular activity. How are renewable energy certificates regulated in different countries? Regulations of renewable energy certificates vary between countries, depending on certification standards and approved energy sources. What are the differences in regulatory frameworks across nations? How is certification achieved? What are the implications of these regulations? Are there any incentives for companies to use renewable energy certificates for crypto mining? The efficacy of incentive models for energy sourcing has been questioned, with the potential to utilize renewable energy certificates for crypto mining being uncertain. What are the implications of these models? How can companies be encouraged to adopt such initiatives? What is the environmental impact of using renewable energy certificates for crypto mining? What is the environmental impact of using energy sources with a carbon footprint? How does this affect energy efficiency? Are there any benefits to utilizing renewable energy certificates for crypto mining in terms of environmental